Learn more about MTS' supplemental retirement program through ICMA-RC, which includes a 401(a), 457(b) and ROTH IRA.

An ICMA representative will be onsite at both IAD and KMD throughout the year to answer any questions you might have.

Learn more about MTS' supplemental retirement program through ICMA-RC, which includes a 401(a), 457(b) and ROTH IRA.

An ICMA representative will be onsite at both IAD and KMD throughout the year to answer any questions you might have.

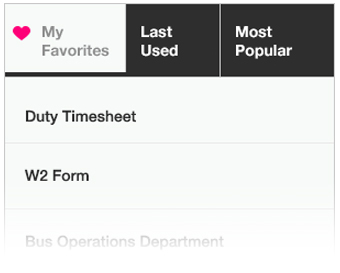

We've worked hard to make sure the new intranet helps simplify everyday tasks and makes it easier to find information about San Diego Metropolitan Transit System. Here a couple tips to get you started!

Get Started